Introduction

From Amazon source:

Amazon’s VAT Calculation Service (VCS) allows Sellers to show VAT exclusive prices to Business Customers and get the Downloadable VAT Invoice badge.

Customers prefer to purchase from Sellers with this badge it represents a guarantee of VAT invoice for each shipment.

Customers also have an option to filter out any Seller who does not have a Downloadable VAT Invoice badge.

Sellers in VCS have two options for invoicing. Sellers can either allow Amazon to create an invoice on their behalf or upload their own invoices. In both the options, Sellers will receive the Downloadable VAT Invoice badge, Amazon will show VAT exclusive prices to Customers and the invoices will be available for Customers to download from their account.

Prerequisites

You have to enroll at this address: https://sellercentral-europe.amazon.com/tax/consolidatedRegistrations?context=enrollment&

Methods

Two methods are possible:

Amazon automatically generates VAT invoices.

You want to generate your custom invoice on the base of the VAT figures provided by Amazon.

If you would like to apply for the first method, you can skip this tutorial.

Setup for uploading invoices

You should use a version at least greater than 4.5.032 Amazon for PrestaShop module. For Shopify, you should contact our customer support: support.amazon-app@common-services.com

If you need an update of your PrestaShop module, please contact our customer support: support.amazon@common-services.com

Setup for PrestaShop

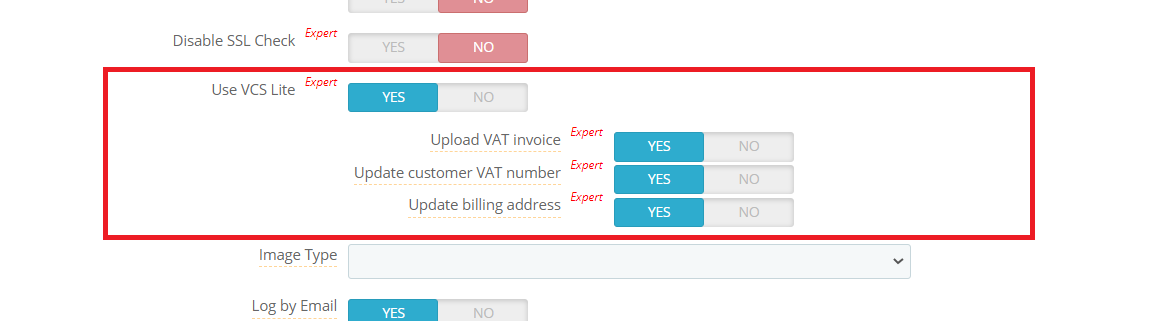

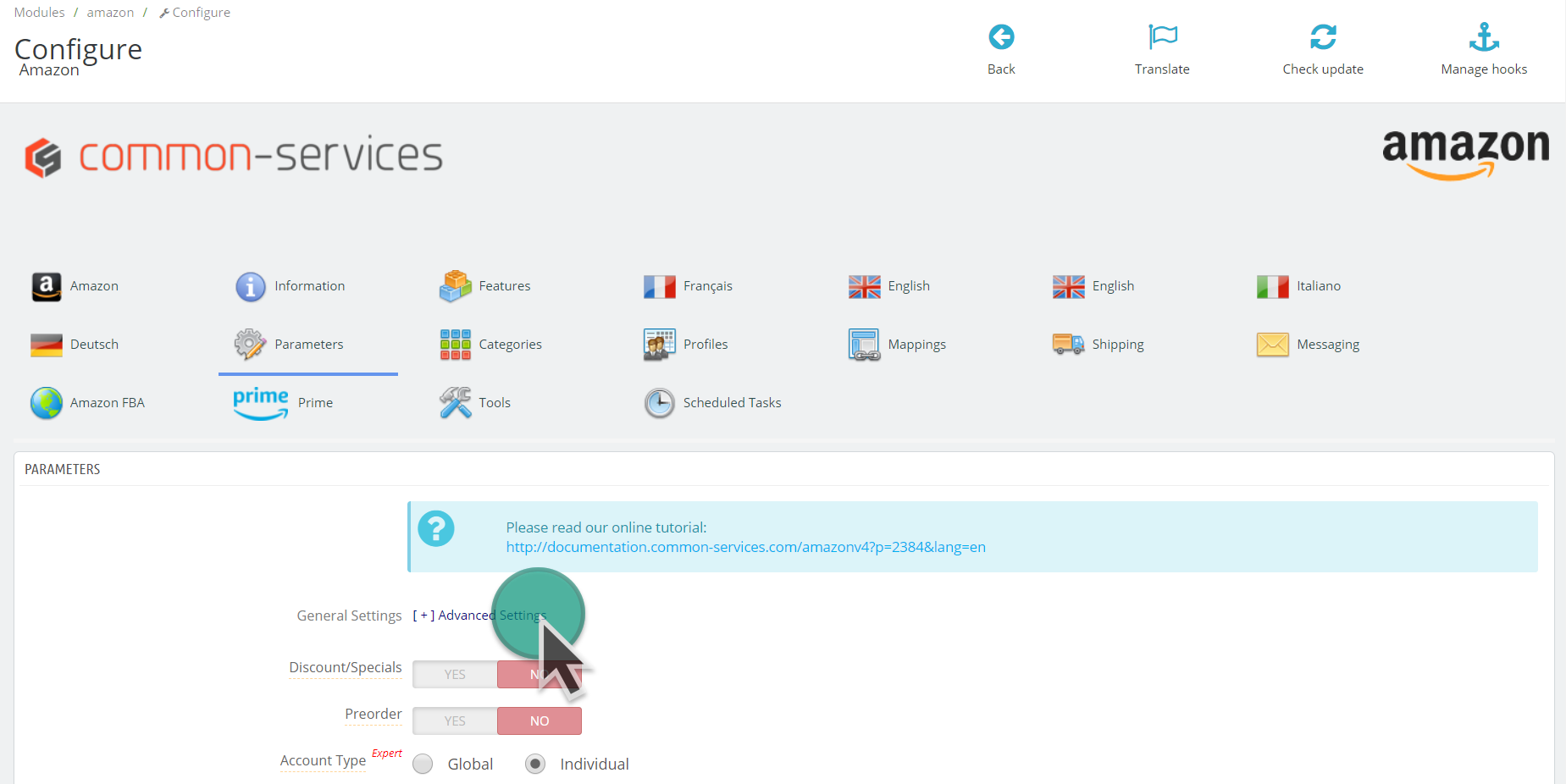

Expert mode must be active.

Settings are accessible in advanced settings:

Then go down till you will find:

Use VCS Lite

Activates in the Scheduled tasks a new entry “VCS jobs”, this cron task will download the tax reports from Amazon and execute other jobs according to other selection:

Upload VAT invoice

Asks to the VCS jobs program to push the invoice to Amazon automatically (including credit note if any).

Update customer VAT number

Asks to the VCS jobs program to update in the customer sheet the VAT number we received from Amazon tax reports.

Update billing address

Asks to the VCS jobs program to update entire customer billing address we received from Amazon tax reports.

Customization

You can customize your invoice with an HTML editor.

Files are available in /amazon/views/templates/front and are prefixed by “vidr”.

Don’t forget to backup your templates in case of module update you will need to restore them.

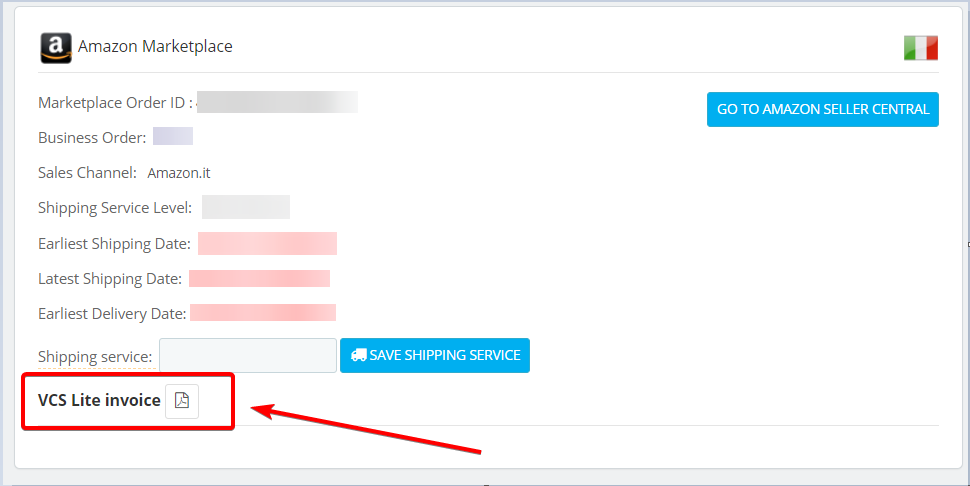

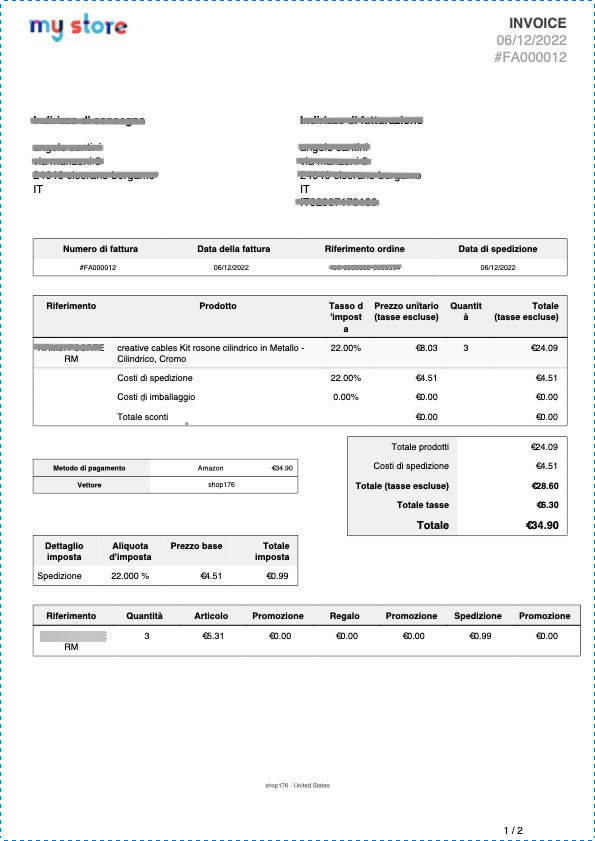

Invoices

You will find the invoice on the order page and also into /amazon/vidr/invoices directory

The module generates invoices itself with data from Amazon.

The invoice layout does not depend on your Prestashop or your other external services.

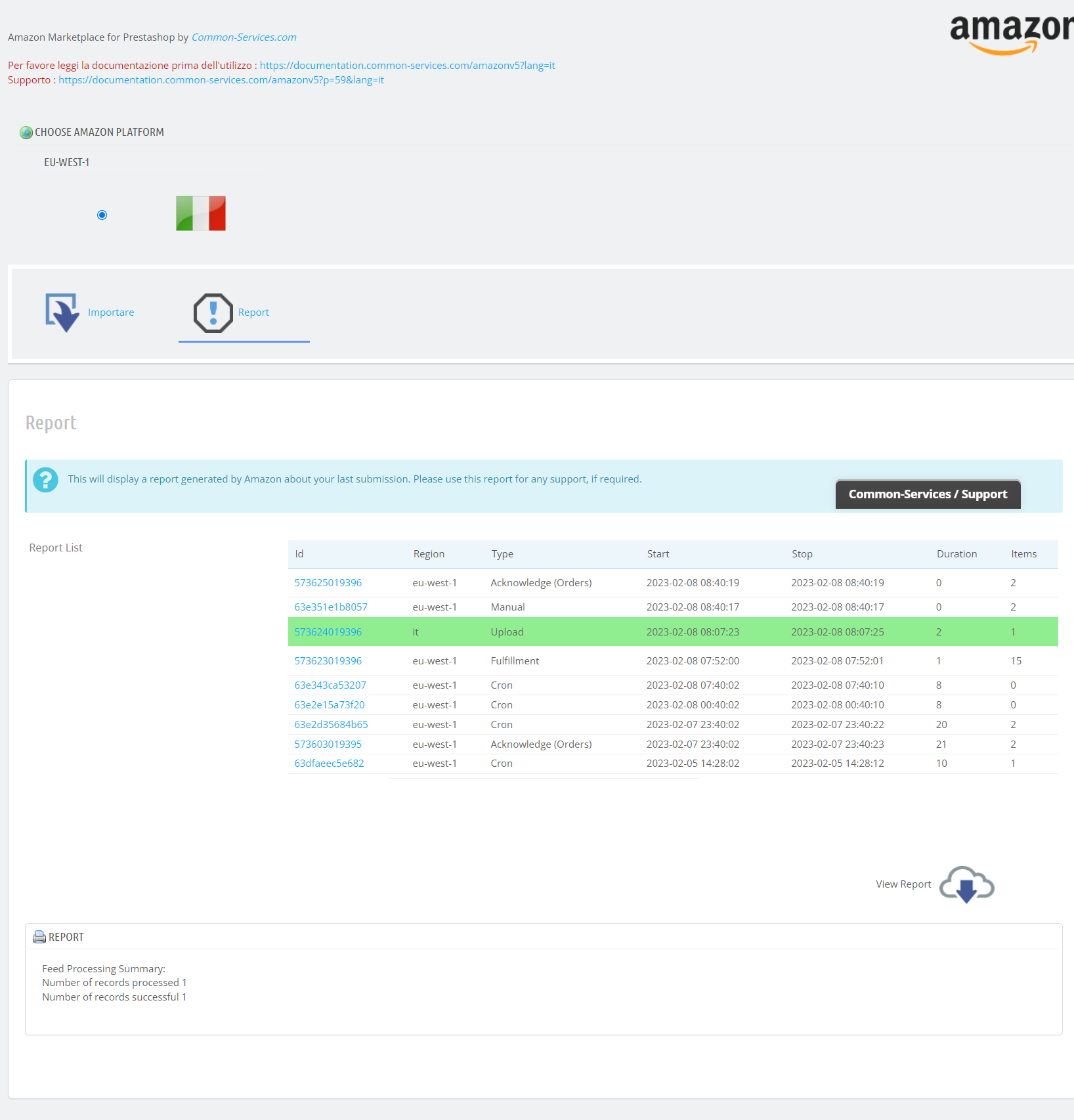

View the uploading report

Support

For any support inquiry please contact us at: support.amazon@common-services.com

Provide us also the logs in /modules/amazon/logs/vcs